days sales in inventory ratio interpretation

The Quick Ratio of this company is good because it is more than 11. The average payment period calculation can reveal insight about a companys cash flow and creditworthiness exposing potential concerns.

Inventory Days Double Entry Bookkeeping

DSO Accounts ReceivablesNet Credit SalesRevenue 365.

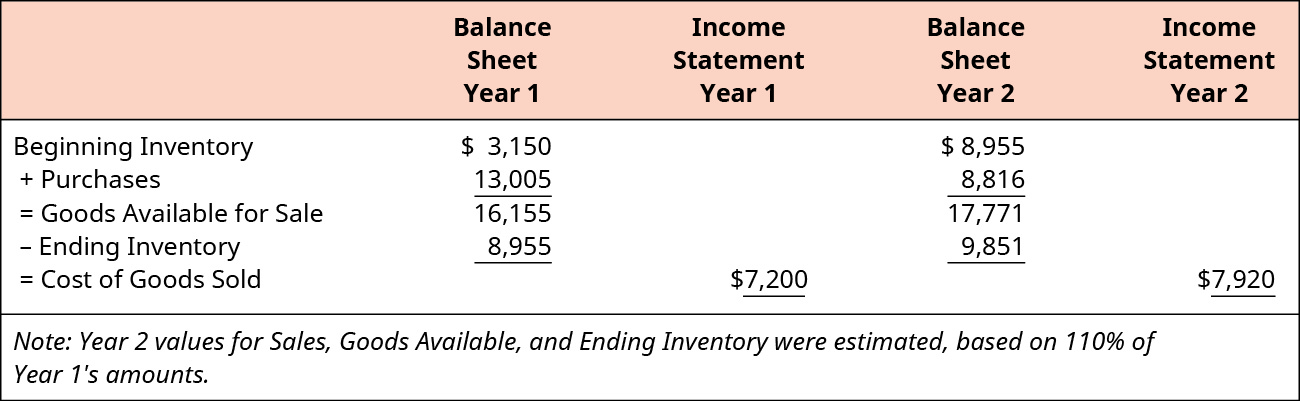

. The smaller the number of days in inventory is the better for the business. Thus a turnover rate of 40 becomes 91 days of inventory. A ratio of 1 is usually considered the middle ground.

Where M Number of Rank at x Y Total number of Ranks Percentile is mainly applied to the data set of scores where ranking needs to be identified. 3656 6083 days. Calculates the proportion of net profit to sales.

Let us consider the following Days Sales Outstanding example to understand the concept better. A WCR of 1 indicates the current assets equal current liabilities. The Days Sales Outstanding formula to calculate the average number of days companies take to collect their outstanding payments is.

As a result Company B has a smaller CDR or DPO ratio. Out of 100 the 25 th percentile is known as 1 st quartile. The interpretation of the days in inventory indicator.

Calculates the time it takes to sell off inventory. To gauge this ability the current ratio considers the current. Now we can use the Marias receivable turnover ratio to calculate its average collection period ratio which would reveal the average number of days the company takes to collect a credit sale.

Average number of days until AR collected. Were taking action to strengthen our sustainability and create long-term value for our shareholders. PG HA Average days inventory in stock 365 Inventory turnover Average number of days inventory held until sold.

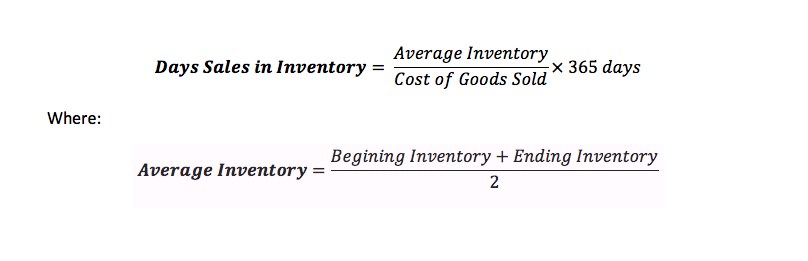

The DOH formula is as follows. Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable. Days of inventory on hand DOH 365 Inventory turnover.

In 2006 To 1557 for 2008 it indicates that firm. We can do so by dividing the number of days in a year by the receivables turnover ratio. A low turnover figure indicates that a business has an excessive investment in inventory and therefore is at risk of having obsolete inventory.

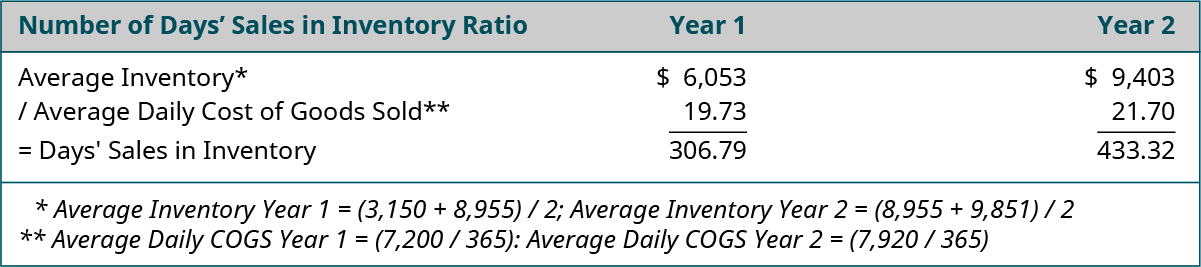

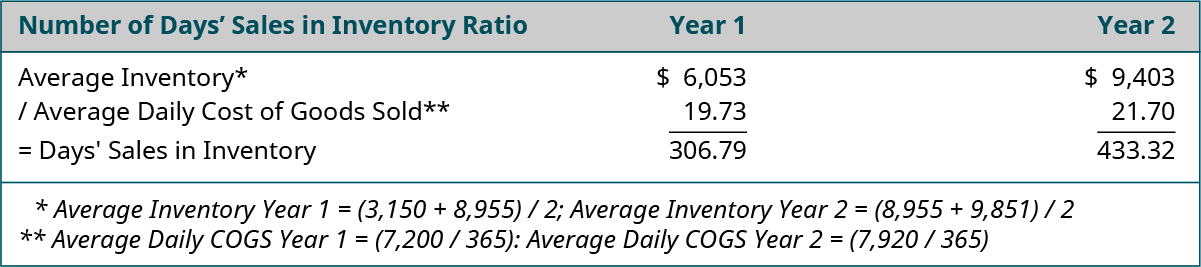

This indicator should be used to compare a companys inventory management versus the average registered in a specific areaor with its own previous ratio to determine the evolution or the improvement. The current ratio is a liquidity ratio that measures a companys ability to pay short-term and long-term obligations. The CDR for company B is 29 days and 365 days for company A.

50 th percentile is known as 2 nd quartile or median the 75 th percentile is known as 3 rd quartile. So what does that mean in practice. PG HA Inventory turnover Cost of goods sold COGS Average total inventory Liquidity of inventory Benchmark.

Days Payable Outstanding Analysis Interpretation. Receivables needed to maintain firms sales level. INVENTORY MANAGEMENT APEX AUTO LTD Holding period of WIP Year Total Days Ratio Days 2008 360 2312 1557 2007 360 3698 973 2006 360 3701 972 Holding period of W I P 18 16 14 12 10 Ratio 8 6 D A Y S 4 2 0 2008 2007 2006 Years As the work in process turnover ratio is increasing form 972.

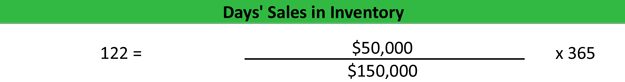

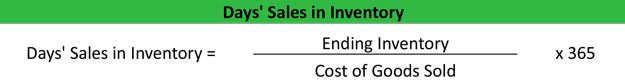

Ratio analysis is used to. You can also divide the result of the inventory turnover calculation into 365 days to arrive at days of inventory on hand which may be a more understandable figure. DOH has an inverse relationship with inventory turnover.

This is known as the inventory turnover period. In addition every 25 th percentile is known as one quartile. We can then use the inventory turnover ratio to calculate another financial ratio namely days of inventory on hand DOH.

Days Sales Outstanding Formula. Here the inventory valuation is deducted from the total current assets to reach at the Quick assets because the inventory cannot be liquidated within 90 days of time therefore it is always advisable to deduct the inventory amount from the current assets to get the exact value of the quick assets. For example a 10 30 credit term gives a 10 discount if the balance is paid within 30 days whereas the standard credit term is 0 90 offering no discount but allowing payment in 90 days.

Problems with the Inventory Turnover Formula. A low proportion can indicate a bloated cost structure or. While Company B has higher trade creditors at the year-end it also has a higher cost of sales.

It shows us how long it took the company to convert its inventory into sales. A ratio analysis is a quantitative analysis of information contained in a companys financial statements.

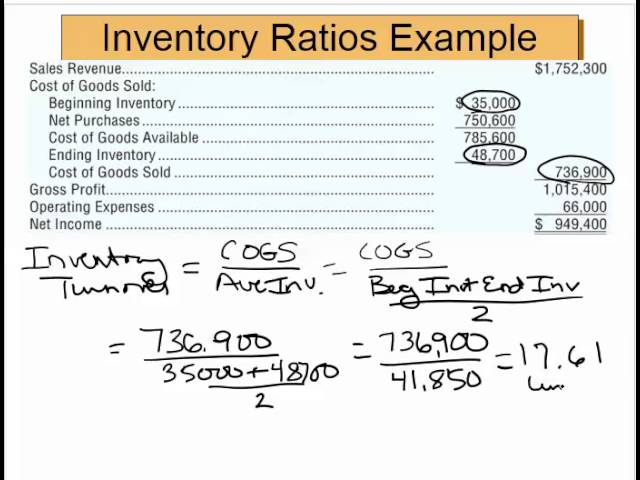

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

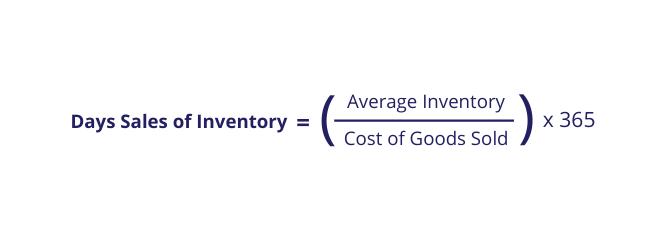

Days Sales In Inventory Dsi Formula And Example Calculation

Days Sales In Inventory Ratio Analysis Formula Example

Days Sales Outstanding Dso Formula And Excel Calculator

Days Sales In Inventory Definition Formula Calculated Example Analysis

Days Sales Outstanding Formula Meaning Example And Interpretation

Inventory Days Formula Meaning Example And Interpretation

Inventory Turnover Ratio Formula Meaning Example And Interpretation

Days Sales In Inventory Dsi Overview How To Calculate Importance

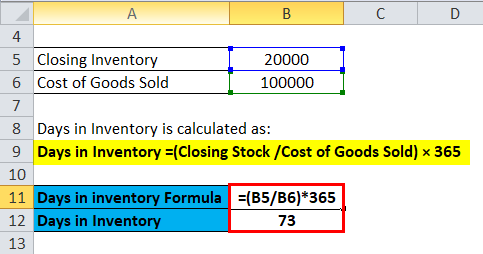

Days In Inventory Formula Calculator Excel Template

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

Inventory Turnover Ratio Days Sales In Inventory The Two Restaurant Inventory Metrics That Will Help You Squash Food Cost Maximize Profits Apicbase

Days In Inventory Formula Calculator Excel Template

Days Inventory Outstanding Dio Formula And Excel Calculator

Inventory Turnover Ratio Formula And Tips For Improvement

Inventory Days Formula Meaning Example And Interpretation

Ineventory Turnover And Days Sales In Inventory Ratios Youtube

Inventory Days Formula How To Calculate Days Inventory Outstanding